Deductions from social grants: how it all works

“First they steal our money, and then we are forced to beg them for a loan”

As the SA Social Security Agency prepares to negotiate a new social grants payment contract with Cash Paymaster Services, Erin Torkelson unpacks the way CPS parent company Net1 is using the payment system to benefit its subsidiary companies.

In October 2016, I met a young mother, Thandeka*, who was crying at one of Khayelitsha’s busiest social grant pay points. A Cash Paymaster Services (CPS) official had informed her that she would only receive 26c of her R350 child support grant. Then, because CPS no longer had any coins available at the pay point, she received nothing at all.

“What must I do now? My daughter expects me to feed her tonight.” In desperate need of money, Thandeka headed toward the offices of Net1 Financial Services to apply for a loan. She said: “You see, with this deductions story, first they steal our money, and then we are forced to beg them for a loan.”

Thandeka’s analysis is spot on.

In 2012, SASSA awarded the five-year R10 billion contract to pay social grants to CPS, a subsidiary of Net1 UEPS Technologies. Later that same year, grant recipients around the country began to complain about a noticeable rise in what have come to be called “deductions.” This is a catch-all term to describe deductions of money – for airtime, electricity, insurance and loans – from grant beneficiaries’ bank accounts. For many, like Thandeka, this is not a matter of a few R5 airtime purchases, but amounts to the disappearance of her child’s entire social grant.

Evidence collected by the Black Sash, civil society, academics, and even SASSA itself has revealed a techno-financial system designed to profit from social grant distribution.

Net1 has created a range of subsidiaries to market financial products and deduct money from grant recipients. These include: MoneyLine (loans), EasyPay Everywhere (smart cards), Manje Mobile (airtime and electricity), and SmartLife (insurance).

Net1 has claimed that only about 21% of its revenue comes from the CPS social grants payment contract, but this does not take into account the revenue from other subsidiaries earned on the back of the CPS contract. US financial analyst Jay Yoon has estimated that this may amount to almost 70% of Net1’s revenue. This would mean that in 2016 some US$ 420 million – about R6 billion – in revenue was made because of the SASSA contract.

This raises a critical question: How did Net1, a company listed on the JSE and on the NASDAQ stock exchange in the US, position itself to profit off the South African social grant system? The answer is biometric technologies.

Winning a tender

The perceived importance of biometric verification allowed Net1 to edge out its competition and secure the 2012 SASSA contract.

Since its inception, the South African social grant system has been dogged by concerns over “paying the right social grant to the right person at the right time and place”. The distribution of social grants has generated suspicions about the potential for beneficiaries to be “duplicated” and paid twice. As far back as 1997, in the White Paper on Social Welfare, the proposed solution to the problem of such fraud was biometric technology. The White Paper advocated a “National Social Grants Register” identified by searchable, “automated fingerprint technology”. Such a system was to take another 16 or 17 years to design.

When SASSA was established in 2006, the agency inherited a decentralised system with separate contracts governing grant payment in every province. Beneficiaries who preferred cash payments (roughly 40%) were served by three companies – AllPay, CPS and Emphilweni. And those who preferred electronic payments (roughly 60%) could choose from several banks, the post office, or a Sekulula account with AllPay (a subsidiary of Absa).

In 2011, SASSA sought to contract a single company which could “consolidate” the grant payment system and biometrically “authenticate” all grant beneficiaries.

CPS was appointed by SASSA. Rival bidder AllPay claimed that SASSA had changed the criteria for biometric verification from “preferential” to “mandatory” just before the deadline. Both CPS and AllPay had the capacity to authenticate beneficiaries during enrolment, but now SASSA wanted grant recipients to show biometric “proof of life” every month. CPS proposed that those who used pay points would scan their fingerprints and those who used bank accounts would verify their voices during monthly phone calls. Judge Froneman ruled that this last minute change reduced the number of viable bids to one – CPS – rendering the processes uncompetitive and precluding a comparison of costs. The Constitutional Court declared the contract invalid in 2014, but suspended the invalidity so that grants could continue to be paid.

Though CPS was given the tender because of its biometric capabilities, in practice the distribution of grants has fallen short of these commitments. The voice verification technology was never sophisticated enough to work effectively and has been virtually abandoned. As a result, the 60% of grant recipients who use ATMs or merchants essentially receive their grants as AllPay had proposed, without monthly verification.

In addition, though the risk of fraud provided the rationale for biometrics, at the end of the registration period in 2013, SASSA reported that only 150,000 total grants had not been renewed (less than one percent). Kevin Donovan, in a report for the Center for Social Science Research, has pointed out that the biometric technology itself failed to catch any “cheaters” at all. The 150,000 people cited simply did not re-register for their grants. Some may have been fraudsters, but others were probably just overwhelmed by the confusion and inconvenience of the re-registration process.

Only the high profile investigations by the Hawks and SAPS fraud unit have exposed grant fraud syndicates. Yet, Social Development Minister Bathabile Dlamini continues to argue that banks should not pay social grants because they lack biometric fraud-prevention technology.

Controlling 17 million biometric profiles

If the CPS biometric database does not meet the objectives of rooting out fraud and verifying all beneficiaries monthly, what does it do?

The development of a National Register of Grant holders gives Net1 control of millions of biometric profiles of grant recipients and beneficiaries.

CPS manages a giant database that contains the recognisable physical features of millions of South Africans. When a person qualifies for a social grant, he or she must go to a SASSA service point, staffed by CPS officials, sitting behind computers and other technical equipment intended to create biometric profiles. During this process, CPS officials collect personal data from beneficiaries, including ID numbers, fingerprints, telephone numbers, phone numbers, and (previously) voice recordings.

Using this information, CPS officials open Grindrod Bank accounts for new grant holders and issue debit cards associated with these accounts. This partnership with Grindrod Bank is necessary because neither Net1 nor any of its subsidiaries has a valid banking licence. When the enrolment process is over, each grant holder’s debit card is linked with his or her mobile phone number, biometric identity markers, and bank account details.

This database has been at the centre of much controversy. In 2015, the National Credit Regulator (NCR) accused CPS of providing information about beneficiaries to Net1 subsidiary MoneyLine. The National Consumer Tribunal ruled against the NCR due to procedural irregularities and Serge Belamant, the CEO of Net1, has strongly denied these allegations.

Even so, the Terms and Conditions of the SASSA card contain the following provision: “you consent to us to send marketing material from us and our affiliates to you, if you elected to receive same during enrolment”. Though the Social Assistance Act explicitly prohibits the sharing of beneficiary information, the terms and conditions of the SASSA card contain a clear statement that CPS can send “marketing material” if consent is achieved. Beneficiaries agree to receive text messages advertising airtime, electricity and loans. In replying to these texts, they consent to having their information shared between Net1 affiliates. There is no need to scan identity documents or enter banking details – CPS already has control of this information. The biometric database makes this so easy, people don’t even realise it’s happening.

Most beneficiaries I have spoken to cannot remember being asked by a CPS official to consent to receiving “marketing material” during their enrolment. And even if every CPS official did diligently ask for “informed consent”, beneficiaries are under pressure to agree to anything in order to get their state entitlements.

Control over this biometric data gives Net1 affiliates a significant advantage over other financial service providers in the low income market. Belamant, in a 2016 earnings call to shareholders, noted that “growth initiatives like EasyPay Everywhere and ZAZOO [Umoya Manje] delivered results above our own expectations.”

Net1’s publicity material claims its products are about financial inclusion for South Africa’s “banked and underbanked” population. Belamant has said that he is pleased with the strong demand for “value-add” products, such as loans, prepaid utilities and insurance. And, indeed, these are products that social grant holders do want and need. However, access to the CPS biometric database – even legally, with consent – gives his companies a huge advantage.

In November 2016, I interviewed Nomalanga*, who gets the R1,510 a month disability grant. For five months, R100 to R160 was deducted from her account for airtime by Umoya Manje. Yet, she said, she did not and would never buy airtime through Umoya Manje, because she sells airtime to her neighbours using MTN Flash and gets a commission for every airtime top-up. She remembers getting an SMS offering “free” airtime or electricity if she texted an Umoya Manje number. She recalls using the “free” promotional airtime, but not consenting to monthly deductions.

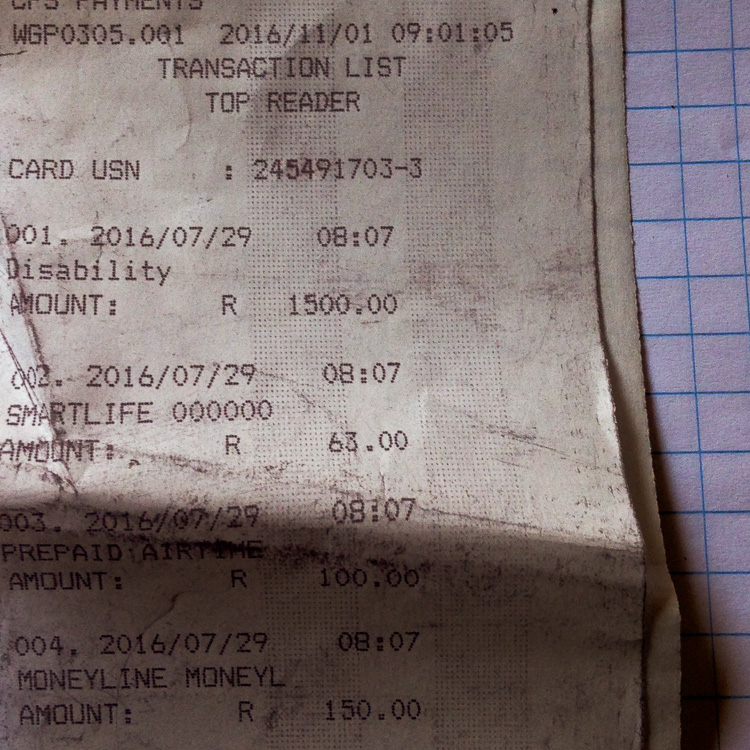

After trying (and failing) to stop the airtime and electricity deductions, she decided her only option was to visit a Net1 Financial Services branch to apply for a loan. Almost a year earlier, she had received a loan through MoneyLine linked to her SASSA card. Her receipts tell the story of how MoneyLine and other Net1 companies deducted her loan repayment every month in the exact minute that her grant was paid. In July 2017, for example, her grant was paid in at 8:07 am on 29 July; at 8:07 am on the same day, R150 was deducted for a MoneyLine loan repayment, R63 was deducted for a Smartlife policy and R100 was deducted for airtime. Nomalanga, like other social grant beneficiaries, cannot default on a MoneyLine loan because her social grant serves as collateral. Yet although there is very little risk to the lender, MoneyLine charges 30 to 40% in “service fees” on every loan.

In November, when she went to apply for a new loan, Nomalanga was ushered into a separate queue and forced to take a green EasyPay Everywhere card. An official asked for her thumbprint, connected to the CPS biometric database and swapped her SASSA card for an EasyPay card. The official also opened up a second Grindrod bank account in Nomalanga’s name linked to this new card. Photographs of the Easy Pay computer show a pop-up box with a message saying: “You are not required to scan ID document as it has previously been scanned.” This demonstrates that Nomalanga’s digital fingerprint allowed Easy Pay to access her information from the CPS database.

After being forced to accept the Easy Pay card, Nomalanga was denied a loan. Yet, every month, her Easy Pay/Grindrod account siphons her grant payment from her SASSA/Grindrod account. With this new card, she is no longer allowed to use SASSA pay points, and must visit ATMs or merchants often with higher fees. She worries about what will happen when she returns to the Eastern Cape. It will be a long and expensive taxi ride to town to get her grant through an ATM, instead of at her village paypoint. She has asked SASSA to help her close her EasyPay card, and has been told there is nothing the agency can do.

Easy to Open, Impossible to Close

Nomalanga’s story began with her unwitting acceptance of monthly airtime deductions, which she has tried desperately to stop. Despite “smashing” her old SIM card, and buying a new one, Nomalanga still faces deductions for a cellphone number she no longer uses. She has sought help from SASSA, from CPS and from the Net1 Financial Services office, without any success. Because Grindrod bank has no physical branches or even ATMs, Nomalanga cannot walk up to a customer service counter and ask for a stop order on the transactions. Because SASSA has no jurisdiction over EasyPay accounts, Nomalanga cannot turn to the agency for help.

Instead of receiving what she is due, she is stuck trying to beg MoneyLine for a loan.

There is a dark irony here. SASSA insisted on biometric technology to avoid the slight risk of being cheated by the poor, only to enter into a deal which allows vulnerable grant beneficiaries to be preyed on by Net1 and its affiliates.

See also: GroundUp’s extensive coverage on the social grants payment crisis

*Not their real names

Views expressed are not necessarily those of GroundUp.

Support independent journalism

Donate using Payfast

Don't miss out on the latest news

We respect your privacy, and promise we won't spam you.

Letters

Dear Editor

I have no arguments or information to provide, other than to say thanks for publishing this article. It sickens me that a government claiming to protect the poor and vulnerable has opened the door to mass exploitation like this.

Dear Editor

Amid all the grim reading of chaos and confusion, this is the only article that actually reports on how illicit deductions are made. This should be the starting point for all the endless commentary about this shameful debacle.

Dear Editor

It's terrible what is happening here. These are not loans, they are rip-offs.

I am not a social grant beneficiary but every month I see people queuing in Athlone at one of these offices only the day after grant payments. This means their grants are already gone, stolen with illegal deductions. Now they must apply again for loans. In reality, they will always stay in debt. It is so sad.

At the end of the day, what is R350 or even R1500? We cannot even feed a family with that kind of money. To steal from the poorest of the poor is disgraceful. Is there nothing the government can do about it?

As the saying goes, the rich get richer and the poor get poorer...

Dear Editor

My husband and I both receive an Older Persons Grant. We were issued with the Debit Cards and were advised we can have our bank accounts linked, IF we want to. As I foresaw possible problems with this, we clarified that we can simply use our debit cards (we enabled our PINs at the SASSA office when the cards were issued) at any ATM to withdraw the grant as cash. I have done this for over 2 years now without a problem and deposit some of the cash into my own bank account.

At no time have we ever been contacted for any of the products you mention in your article, so I'm not sure that the facts are correct with regard to what info is passed on to the parties you mention.

My only query is what Grindrod Bank's charges are, as we seem to have about R31.00 deducted each month and I can only do a balance enquiry at the ATM and not get a statement showing what these charges are for. If it's an ATM Cash Withdrawal Fee, it does seem to me excessive. Although it's not a large amount, multiply by the number of grantees, it adds up to a substantial amount of money.

I would appreciate it if anyone could enlighten me on how one gets a statement from Grindrod Bank.

My last point is, it seems to me that the bulk of grantees, due to lack of education, do not understand what they are agreeing to and are despicably taken advantage of.

Dear Editor

For the last three months, fees of between R3.50 to R6.00 have been deducted from mine and my wife's old-age grant so I contacted SASSA offices in Krugersdorp. They said that I must take it up with CPS as this is a fee they sometimes deduct for using external (out of contract) facilities [to withdraw your grant]. I contacted Shoprite/Checkers and spoke to their national manager. She said she would investigate and come back to me. She did contact me a week later and informed me that they are contracted to Net1 & CPS.

I sent CPS an email regarding this and a lady phoned me back. She informed me that I am liable to pay these fees as Shoprite/Checkers Monument branch. This is confusing because my withdrawal slips say Grinrod which is connected to CPS/ Net1.

The CPS representative advised me to go to Pick &Pay outlets as they are contracted to CPS and Net1 and I will not pay any fees.

What a maze.

Dear Editor

For the last six+ months I've been short-paid odd amounts and on querying it Sassa blames Checkers/Pick n Pay on contacting them they advise they only pay what sassa has put in your account. On referring it back to Sassa they blame Visa and so the lies go and money is stolen. I have always drawn the cash so not in debt to air time or anything else. So it is outright theft!

© 2017 GroundUp.

This article is licensed under a Creative Commons Attribution-NoDerivatives 4.0 International License.

You may republish this article, so long as you credit the authors and GroundUp, and do not change the text. Please include a link back to the original article.