Sassa system to refund unauthorised debits “not working”

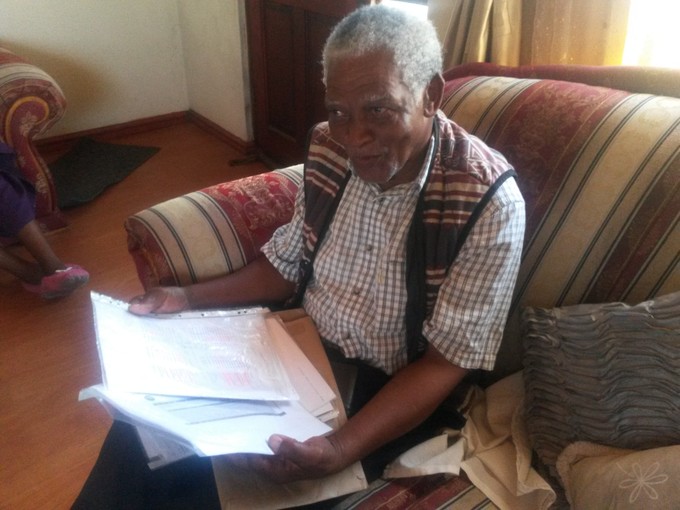

An 88-year-old Nyanga resident has had over R2,400 deducted from his pension since April last year for a loan he says he never made.

“I used a lot of money to investigate what happened. I really need that money. I’m getting old now and it’s not safe in my area anymore. I need that money to fix my house,” said Sipho Lennox Bani.

In October last year, the South African Social Security Agency (Sassa) implemented a new system it claimed would assist beneficiaries to resolve disputes for unauthorised deductions and refund their money. But according to Black Sash, Bani is among hundreds of beneficiaries who are yet to be refunded.

It comes as Social Development Minister Bathabile Dlamini announced in December 2015 that all deductions from child grants will be stopped from 1 January. Legally, the only deduction which can be made from all social grants before it is paid to a beneficiary, is a 10% deduction for funeral insurance. But once the money is in the beneficiary’s bank account, he or she can authorise other deductions.

Due to an increase of unauthorised deductions, Sassa introduced a policy to block all debit order deductions related to funeral policies from child grants in November last year. Insurer, Lion of Africa, applied for an urgent interdict against Sassa in the North Gauteng High Court in a bid to stop the implementation of the policy.

Sassa has lodged an appeal in the Constitutional Court. No deductions will be made on these grants until the matter is heard later this year.

Meanwhile, Bani said he spent over R500 on transport to different Sassa offices to have the monthly deductions of R307 stopped. He usually receives a R1,440 old age grant.

“I was sent to Sassa offices in Gugulethu, Lansdowne and Durbanville. None of them could help me. I was told in Bellville to fill out a form and they will investigate my case. I then went to the Cape Town office. There I was told I need to go to FinBank,” he said.

Bani said he was advised to approach Black Sash for help. He said he was forced to make a loan in order to make payments.

“If i get that money back, I can pay this loan and I can finally fix my windows before winter,” he said.

Black Sash regional manager Colleen Ryan said it was good that Sassa was taking steps to assist beneficiaries, but the system was not working.

“We sit on the ministerial task team, so we took Mr Bani’s case to show just how the dispute resolution mechanism was not working for beneficiaries. The system is fraught with many problems as it is,” she said.

Sassa spokesperson Lisa Kindo said that they would investigate Bani’s case and provide feedback by Friday.

“When a case is registered, staff will refer the matter for investigation. Where the beneficiaries have not authorized the deductions or allowed for their SASSA cards to be used by others, the deducted amounts will be paid back to them. This is usually done within a period of three working days,” she said.

“However, the monies will only be paid back once the matter has been investigated to ensure that there was no negligence. Sassa is fully dependent on Cash Paymaster Services (CPS) to investigate all matters,” she said.

CPS is the company responsible for paying social grants.

Matthews Tshofuti, paralegal at Gugulethu Advice Office, said that of the dozens of beneficiaries who have complained to him about unauthorised deductions, none of them have been refunded from CPS.

“I have dealt with many cases where microlenders like furniture stores take more than the agreed monthly installment. I have managed to get people’s money back from the microlenders, but not for airtime and electricity deductions. In all the people I’ve helped, not one has told me that they got their money back from CPS,” he said.

To report unauthorised debits, contact the Western Cape helpline at 021 469 0235. To lodge any complaint contact the call centre at 080 060 1011.

Support independent journalism

Donate using Payfast

Don't miss out on the latest news

We respect your privacy, and promise we won't spam you.

Next: Wolwerivier without running water

Previous: Hefty fines for asylum seekers at Port Elizabeth refugee centre

© 2016 GroundUp.

This article is licensed under a Creative Commons Attribution-NoDerivatives 4.0 International License.