Protest to demand that the old-age grant be increased to R5,000 per month. The authors of this article argue that expanded social security, rather than a high national minimum wage, should be used to alleviate poverty. Photo by Ashleigh Furlong.

26 November 2015

Deputy President Cyril Ramaphosa is hosting a social dialogue between business, labour and other constituencies over setting a national minimum wage (NMW). This is the final installment of a three part series by two University of Cape Town professors.

Part one looked at the level of a South African minimum wage using international benchmarks and part two looked at the direct effects of minimum wages on job destruction. Here they discuss the relationship between minimum wages and the growth path, questioning the claim that higher minimum wages would have indirect effects on job creation.

Most empirical studies find that minimum wage increases have a limited if any direct impact on employment. This is because policy makers are generally cautious, and not all firms comply with the legislated wages (see part two). Furthermore, most studies focus on the short-term effects. Recent empirical work indicates that the direct effect of higher minimum wages on job destruction only shows up in the longer term as firms slowly replace labour with machinery as they shift away from labour-intensive technology (Sorkin, 2015; Meer and West, 2015).

For example, Aaronson, French and Sorkin (2015) examined the mechanism through which firms substitute capital for labour in the USA. They found that existing employers in the fast-food restaurant industry are unable easily to substitute capital for labour in response to minimum wage increases, but new employers – who are typically restaurant chains – can do so. Even over the short-term, industries adjust to changed wages through the exit of more labour-intensive employers and the entry of less labour-intensive ones.

In light of this research, The Economist backed away from its earlier endorsement of minimum wages, concluding that evidence of modest short-term effects might be a ‘poor guide’ to the long-term effects of large increases.

There is, however, a rival narrative about the impact of increasing minimum wages on the growth path. This story suggests that minimum wages will boost job creation overall by putting increased purchasing power in the hands of low-paid workers. As they go shopping, sales increase, encouraging firms to produce more output and hire more workers. Theoretically, such ‘wage-led growth’ is possible if higher domestic sales generate sufficient profits and funds for investment to compensate domestic firms for the increase in labour costs. But this happy scenario is less likely in an open economy and ultimately depends on what drives profits and investment in any particular economy.

Is wage-led growth possible in South Africa?

Two published macroeconomic analyses of the South Africa economy (using data from the 1990s and 2000s respectively) concluded that this kind of wage-led growth was not feasible in South Africa, and that increasing the share of income going to wages would probably undermine investment, growth and employment (Gibson and Van Seventer, 2000; Oranan and Galanis, 2013).

A recent simulation by the South African National Treasury comes to the same conclusion, notably that South Africa ‘is profit / investment driven’ rather than ‘wage / consumption driven’ because profits are the main source of funding for investment and wages, and because a significant amount of consumption (following from wage increases) gets spent on imports (MacLeod, 2015).

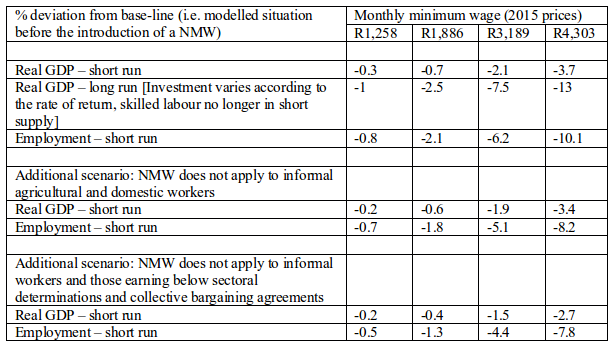

The National Treasury uses their macroeconomic model to predict the impact of four different levels for a NMW. Key results are reported in Table 3. Setting the NMW at 60% of the median wage (i.e. R1,886, which is close to the minimum wage for non-metro domestic work) is predicted to result in a 2.1% fall in employment and a 2.5% fall in output over the longer term. This would affect 45% of unskilled workers, 43% of workers in agriculture and 52% of workers in private households.

The model projects that assuming full compliance, the economy would become less labour-intensive (MacLeod, 2015). The National Treasury provides several projections for different levels of the NMW (including household poverty lines), with higher wages generating worse economic outcomes especially for the poor. This is consistent with the macroeconomic simulation by Pauw and Leibbrandt (2012) which concluded that higher minimum wages hurt the poor and hence was not an appropriate instrument for addressing household poverty.

Table 3. Macroeconomic modelling results (summary) from the National Treasury: Source: MacLeod, 2015

Table 3. Macroeconomic modelling results (summary) from the National Treasury: Source: MacLeod, 2015One of the reasons why minimum wages have a generally muted impact on employment in developing countries is because governments tolerate significant levels of non-compliance. Studies suggest that there are high levels of non-compliance in South Africa: 34% of workers in retail earn below the sectoral determination, 39% in domestic work, 53% in forestry, 47% in the taxi industry, 67% in private security and 55% in agriculture (reported in MacLeod, 2015).

The National Treasury provides several additional scenarios assuming that the NMW does not apply (presumably because non-compliance will be tolerated) to certain categories of worker. We report two of these scenarios in Table 3. They show that the employment and output impacts are much lower if informal, agricultural and domestic workers are exempted, and even lower if those already earning below collective bargaining agreements (as in workers in non-compliant clothing firms) are also de facto excluded. Even so, the impact on employment remains negative.

The National Treasury’s modelling work suggests that a cautious approach to NMW setting is advisable. But models are not infallible and will vary depending on assumptions and data sources. Ideally, a team of independent experts (perhaps drawn from the Reserve Bank and the major universities) should evaluate the rival economic models and test them against what we know about South African economic dynamics. In the interim, however, it is worth pointing out that the National Treasury model is plausible given that it is consistent with other South African macroeconomic models based on data from the 1990s and 2000s (Gibson and Van Seventer, 2000; Oranan and Galanis, 2013) showing that growth in South Africa is profit-led rather than wage-led.

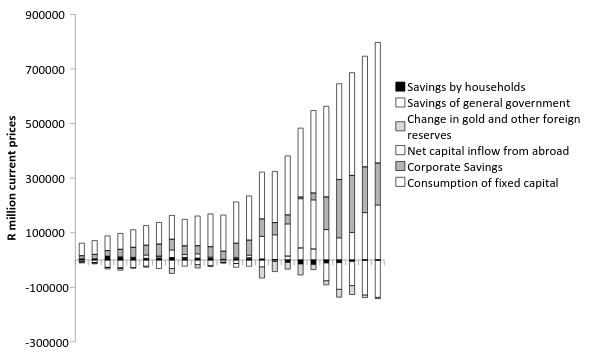

Furthermore, the National Treasury model is consistent with evidence showing that wage increases in tradeable sectors have undermined competitiveness and hence resulted in employment losses. It is also consistent with the fact that the South African economy is not demand-constrained. As shown in Figure 4, capital accumulation in South Africa relies on corporate savings (out of profits) and on capital inflows because the government and household sectors are typically net borrowers.

Figure 4. The financing of gross capital formation. Source: Data from the South African Reserve Bank. See www.reservebank.co.za/

Figure 4. The financing of gross capital formation. Source: Data from the South African Reserve Bank. See www.reservebank.co.za/Put differently, South Africa’s economic problem is in large part due to a shortage of savings, not demand. It is precisely because consumption continually runs ahead of production capacity that imports are sucked into the economy, and it is because South Africans are net borrowers rather than savers, the country needs a constant inflow of foreign savings to accommodate the current account deficit and help finance capital accumulation. Wage-led growth is thus unlikely to be sustainable.

According to data presented by Finn (2015a, 2015b) and the National Treasury, a very high proportion of low-skilled workers and workers in tradeable sectors like agriculture and clothing would be affected by a NMW in the range of R1,900 to R3,000. This implies that unless additional support (perhaps through industrial policy assistance and the like) are provided to these sectors, these last remaining labour-intensive tradeable sectors are likely to shed even more workers if a NMW is set within this band. Large numbers of domestic workers would also be affected, but as this is not a traded sector and non-compliance is rife, fewer job losses are likely.

Ultimately, it is impossible to predict precisely the employment impact of any particular level of the NMW. There is no substitute for empirical investigation on a sector by sector basis. One option is to request the ECC to make a sectoral determination to cover any workers not already covered by existing collective agreements or sectoral determinations. If this is to be deemed a NMW, then it should ideally not be higher than existing sectoral determinations in order not to generate job losses. Given that this will inevitably be at a low level, more attention should be paid to addressing poverty through increased welfare grants to poor households and to expanding the public works programme. Note, however, that if the NMW is set higher than the lowest public works programme wage (currently R1,500 a month) then additional resources would need to be channelled to the public works programme budget in order to grow the programme.

The aim of minimum wages is to ensure employees are not exploited and earn a decent living, an objective we support. As we have shown though, an NMW can have also put people out of work, which also prevents them earning a decent living. Given the massive challenge of unemployment in South African already, and the flaws in the arguments that a high NMW would generate wage-led employment growth, very careful attention must be paid to the risks that a NMW would destroy jobs in South Africa’s remaining labour-intensive sectors and thus worsen unemployment and poverty. Minimum wages should therefore continue to be set on a primarily sectoral basis, taking into account conditions in each sector, as at present under existing legislation.

A NMW should be set to provide a low national minimum wage floor for workers who are not covered by existing sectoral minima. This can be done through the existing Employment Conditions Commission, under the Basic Conditions of Employment Act. Until there is large-scale job creation in South Africa, wages will continue to be insufficient to raise all workers and their dependents out of poverty. The appropriate solution to poverty is not to raise all wages to a level that destroys jobs, but to expand the social security system.

Aaronson, D., French, E., Sorkin, I., & Michigan, U. 2015. Industry Dynamics and the Minimum Wage: A Putty-Clay Approach. Federal Reserve Bank of Chicago (May 25).

Adelzadeh, A. 2015. Potential impact of introducing National Minimum Wage in South Africa, Presentation to the NEDLAC Technical Committee, 19 October.

Finn, Arden. 2015., ‘A National Minimum Wage in the Context of the South African Labour Market’, National Minimum Wage Research Initiative Working Paper no.1 (Johannesburg: University of the Witwatersrand, August).

Finn, A. 2015b. A National Minimum Wage in the Context of the South African Labour Market. Powerpoint presentation, 17 August 2015.

Gibson, Bill, and D. van Seventer. 2000., ‘Real wages, employment and macroeconomic policy in a structuralist model for South Africa’, Journal of African Economies 9,4: 512-546.

MacLeod, Catherine. 2015. Measuring the impact of a National Minimum Wage, National Treasury, October.

Meer, J., and J. West. 2013. Effects of the minimum wage on employment dynamics (No. w19262). National Bureau of Economic Research.

Onaran, Özlem, and Giorgos Galanis. 2013. ‘Is aggregate demand wage-led or profit-led? A global model’, in Marc Lavoie and Engelbert Stockhammer (eds), Wage-led Growth: An Equitable Strategy for Economic Recovery (Basingstoke: Palgrave Macmillan): 71-99.

Pauw, K., and Murray Leibbrandt, 2012. ‘Minimum wages and household poverty: general equilibrium macro-micro simulations for South Africa’, World Development 40,4: 771-83.

Sorkin, Isaac. 2015. ‘Are there long-run effects of the minimum wage?’, Review of Economic Dynamics 18,2: 306-33.

Part one: Comparing South Africa to other countries

Part two: what will happen to jobs?.

Views expressed are not necessarily GroundUp’s.