18 February 2025

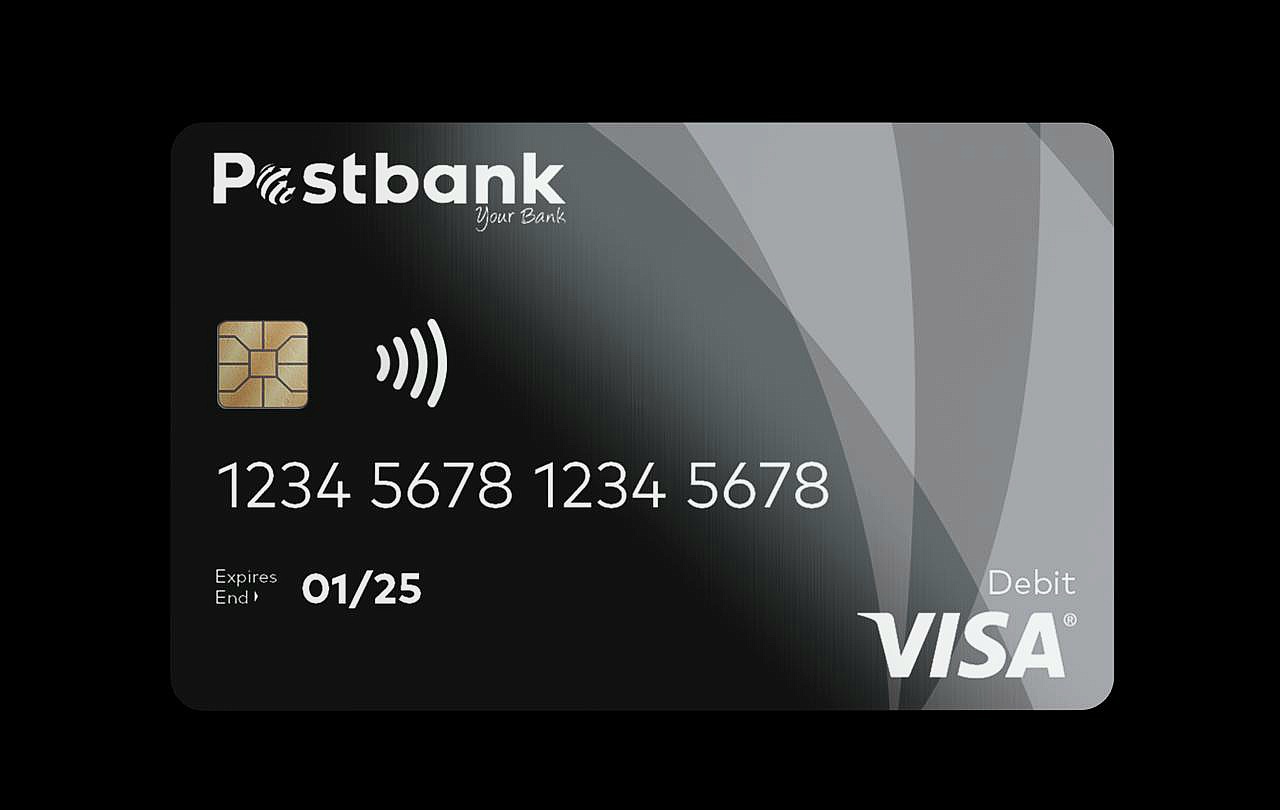

Postbank is trying to switch millions of social grant beneficiaries to a new card. But the speed of the switchover is much slower than planned. Image supplied by Postbank

More than two-million social grant beneficiaries still need to switch from the SASSA/Postbank Gold Card to the Black Card. This is according to Postbank CEO Nikki Mbengashe.

Addressing Parliament’s social development committee on Tuesday, Mbengashe provided updates on the card swap process and measures to reduce long queues. She said about three-million people use the SASSA Gold Card but only 629,000 have switched to the Black Card.

The government extended the deadline for replacing the Gold Card from 28 February to 20 March, giving people more time to transition. Postbank said the new cards have enhanced security and meet updated banking standards.

The transition has been marked by difficulties, including long travel distances to service points for beneficiaries, long queues, and the system often going down.

Postbank has not met its goal of issuing 23,000 cards daily. “The main reason was that 90% of the time, people were just not showing up. Our tellers were sitting there doing nothing for the first three months. Yes, intermittently the connection to Home Affairs was 10% to blame, but truly 90% of the reason was because people just didn’t show up,” said Mbengashe.

Between November and January, 2,300 to 3,500 cards were issued daily. But since 7 February it increased to an average of over 10,400 per day. “You could see that as soon as we communicated the deadline, people knew there was pressure. The next day, we more than doubled what each site was doing per day,” Mbengashe said.

To meet the three-million target by March, Mbengashe said Postbank would need to issue 100,000 cards per day.

To accelerate the process, Postbank announced that it is partnering with the Spar Group, which will provide 200 stores as service sites nationally. “We’ve negotiated with them because, although we have sites, the issue is people to man them. Training takes five days, and recruitment and vetting are required. We needed a partner who could provide people familiar with financial services to do the job on our behalf,” Mbengashe said.

The Spar Group’s tellers, already trained in handling financial transactions, will receive “accelerated training,” reducing the timeframe from five days to two through on-the-job training with experienced tellers, Mbengashe said. Postbank also plans to increase the number of tellers per site.

Another intervention involves improved communication with beneficiaries, including issuing press releases.

To ease congestion in queues, Mbengashe said Postbank is expanding the cardless cash withdrawal system, which allows beneficiaries to withdraw grants at retailers using their ID and a registered cellphone number. “We are working around the clock to expand the cardless cash withdrawal option. It’s very easy to onboard a beneficiary, so this will alleviate the pressures in the queues,” Mbengashe said.

Postbank is also trying to improve security measures for beneficiary registration. “We’re finalising an app that our staff will use to onboard customers securely and ensure compliance,” she said.

To handle high call volumes, Postbank said it doubled its contact centre staff and is recruiting more people. SASSA has also offered its call centre during the switchover.

To help people locate service sites, Mbengashe said Postbank has made site information available on LinkedIn, Facebook, TikTok, and its website. Beneficiaries can also use the USSD code (*120*218*3#) to find their nearest site. (Though GroundUp has found that this doesn’t work consistently)

Mbengashe assured beneficiaries that Postbank’s sites will remain open beyond 20 March, and additional sites may be added. “If people get their grant in March, they have almost the whole of March to get the black card. We will continue increasing sites to prevent a backlog in April,” she said.

SASSA’s acting CEO Themba Matlou acknowledged communication issues with the transition.

“We have identified major hotspots and are introducing special outreach interventions to target these areas,” Matlou said. Community halls are being used as service points to provide beneficiaries with access to ablution facilities and shelter while waiting.

To manage long queues, SASSA has assigned two employees per site and prioritised elderly beneficiaries. The agency has also extended system hours to expedite processing.

Postbank said it aims to have black cards issued to all three-million gold card users by 30 June.