30 January 2026

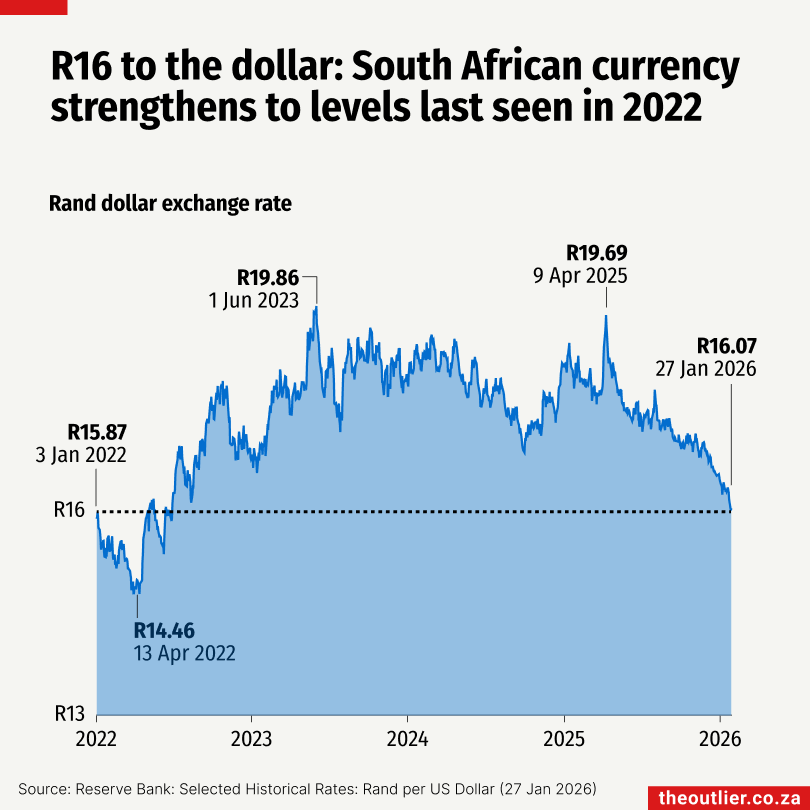

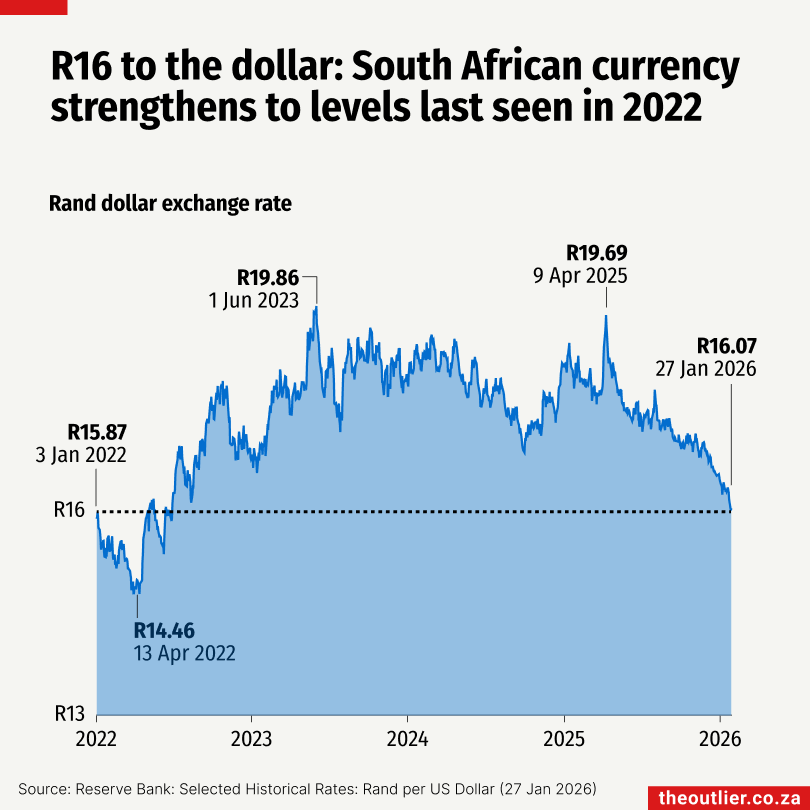

Image provided by The Outlier

In his quarterly statement on Thursday, Reserve Bank governor Lesetja Kganyago pointed out that the rate of inflation in the price of goods is low, thanks partly to the stronger rand. The inflation rate for goods is at 3% a year, which is the target the Reserve Bank aims for when it sets interest rates.

One reason for this is that the rand has strengthened against other currencies, especially the US dollar.

But what does this mean?

The number of dollars you can buy with one rand (or, as it is more usually expressed, the number of rands you can buy with one dollar) is called the exchange rate of the rand to the dollar.

If you want to travel to the US you could go to your bank and “buy” dollars - exchange your rands for dollars which you can spend in the US. The same applies to firms which want to import goods from the US: they have to “buy” dollars to pay for them.

The rate the bank will give you changes from time to time as people and companies buy and sell the currency, and it may not be the same from one bank to another.

According to the Reserve Bank, which gives a weighted average of rates quoted by the main banks, on 2 January 2025 the dollar was worth R18.76. On 31 December 2025, the dollar was worth just under R16.60.

In other words, the rand strengthened over the year against the dollar: someone who wanted to exchange dollars into rands would have got fewer rands at the end of the year than at the beginning. And someone who wanted to exchange rands into dollars would have got more dollars at the end of the year than at the beginning.

Over the same period, the rand strengthened against the euro, the British pound, and the currencies of many of our other trading partners, though not by as much as against the dollar.

A stronger rand against the dollar means that it should be cheaper for South Africans to buy goods which are priced in dollars. A 10 dollar computer game which cost R187 at the beginning of the year should have cost R166 at the end - if, of course, the computer game shop passed on the benefits of the lower price to customers.

In contrast, someone who wanted to sell goods which are priced in dollars — a farmer, say, selling wheat on the world market — would get fewer rands for the dollars they have earned at the end of the year than they would have got at the beginning.

The rand exchange rate, and, especially, people’s expectations about the rand exchange rate, have ripple effects all the way through the economy. The country’s economic growth rate is affected ; company share prices on the JSE are affected by whether the company is an exporter or an importer, or both. Pension funds and other savings are affected too, because they hold investments on the JSE and in other countries.

And, as the Reserve Bank pointed out again on Thursday, the inflation rate is affected. When the rand weakens, inflation tends to increase; when the rand strengthens, it tends to fall. This in turn affects the interest rate decisions taken by the Bank. The Bank has decided to keep interest rates steady in spite of the stronger rand and lower inflation. But if rand strength persists, and inflation stays near the target range, a cut in interest rates may be on the cards.