29 September 2025

The high court in Pretoria has struck Postbank’s urgent application to stop the termination of its contract with the South African Social Security Agency (SASSA) from the court’s urgent roll. Archive photo: Ashraf Hendricks

The Gauteng High Court in Pretoria has struck Postbank’s urgent application to stop the termination of its contract with the South African Social Security Agency (SASSA) from the court’s urgent roll. This means the Master Service Agreement (MSA) between the two entities will lapse on Tuesday, 30 September.

The MSA was introduced in 2018 to protect social grant beneficiaries from incurring bank charges and unauthorised deductions, which had been a major problem under the previous payment contractor, Cash Paymaster Services.

Instead of charging beneficiaries, Postbank recovered social grant transaction costs via the payment it received from SASSA.

The MSA also locked Postbank accounts against deductions, shielding beneficiaries from unlawful debit orders. (SASSA has acknowledged an increase in reports of unauthorised deductions on private bank accounts, with CEO Themba Matlou saying in August that the agency was “deeply concerned” by complaints from beneficiaries who report deductions by insurance companies.)

Once the MSA ends, these protections fall away: beneficiaries may lose the safeguard against unauthorised deductions. Also, Postbank will now have to either absorb transaction costs or pass them on to beneficiaries.

In December 2023, SASSA gave Postbank six months’ notice to terminate the contract, citing a breakdown in their relationship and reputational risks caused by Postbank’s shortcomings. The notice was later withdrawn, but in March 2024, SASSA issued a new 18-month termination notice. The contract is set to end on 30 September 2025.

Postbank approached the Gauteng High Court on an urgent basis to interdict SASSA from going ahead with the termination. The bank argued that the cancellation was unlawful because the dispute resolution process set out in the agreement had not been followed.

Postbank said it was acting not only in its own interest but also in the interests of millions of beneficiaries. It warned that without the subsidies provided under the MSA, beneficiaries will have to pay commercial banking fees for services such as mini-statements, balance enquiries and card replacements.

SASSA rejected Postbank’s claims, saying no such subsidies existed, and accused the bank of abusing urgent court procedures to delay the contract termination. It argued that beneficiaries would not suffer irreparable harm because their grants would continue to be paid.

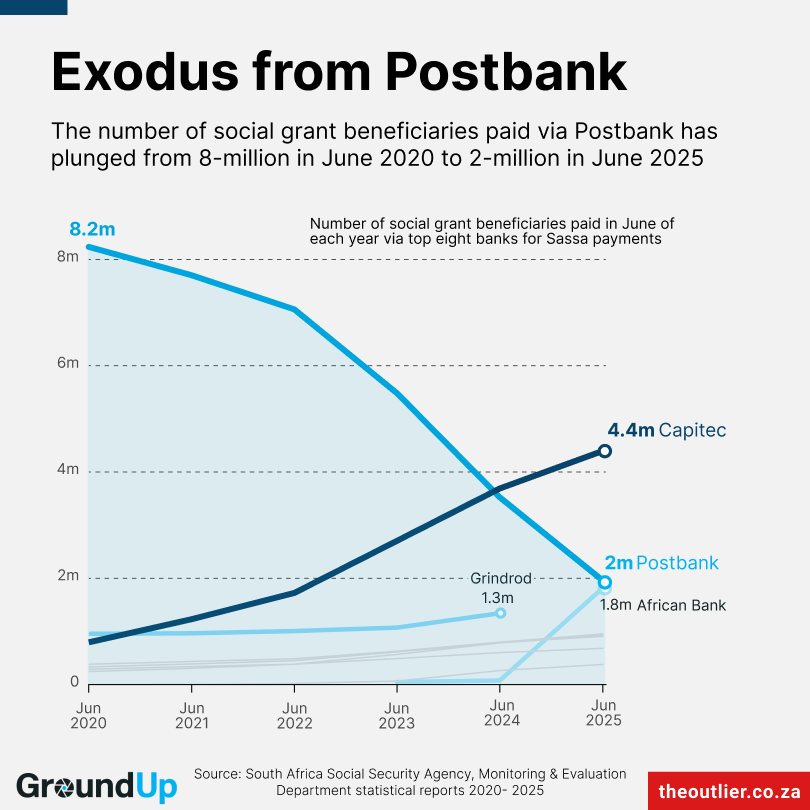

There has been a sharp drop in Postbank social grant clients since 2020. Payment delays, technical problems, and a chaotic card swap appear to have pushed clients towards private banks. Read more.

On Friday, Judge Colleen Collis stated that Postbank had “created its own urgency” by waiting until 1 September to bring the application when it had known since 8 March 2024 that the MSA would be terminated on 30 September 2025.

“The undue delay of approximately 18 months by [Postbank] to have instituted legal proceedings has not been adequately explained before this court. It is for those reasons that this court declines to exercise its powers … and consequently the application is struck from the urgent roll with costs,” Collis said.

Following the ruling, Postbank, in a statement, expressed concern for beneficiaries, saying the judgment offered “inadequate reprieve to millions of social grant beneficiaries whose livelihoods and rights will be affected”.

The bank added that the protection of beneficiaries remains a critical issue that “has not yet been given due consideration”. Without urgent intervention to safeguard beneficiaries’ rights before the contract ends on 30 September 2025, Postbank warned that the constitutional rights of millions of beneficiaries could be infringed.

However, the state bank assured that payments to beneficiaries using Black Cards and SASSA Gold Cards will continue on time and remain accessible through retailers and ATMs for all upcoming grant cycles.

SASSA welcomed the judgment. “We would like to, once more, emphasise that all the eligible grant beneficiaries with accounts at Postbank will continue receiving their grants.

“Our beneficiaries can open an account into which to receive their social grant with any bank of their choice, and we assist them. In this instance, those with Postbank will continue to receive their grants and the termination of the MSA has no bearing on that,” said SASSA CEO Themba Matlou.