4 October 2022

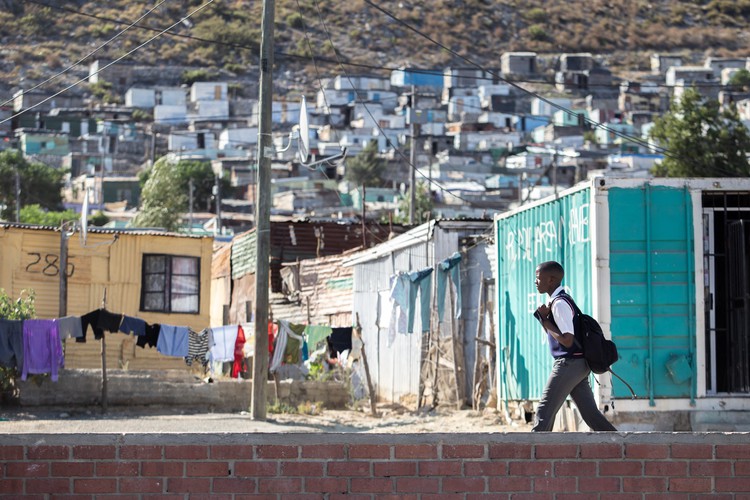

South Africa can afford to pay a Universal Basic Income Grant, says the writer. Archive photo of Villiersdorp: Ashraf Hendricks

The first two articles in this series focused on defining a Universal Basic Income Grant (UBIG) and explaining its impacts and the evolving debate about its implementation. One of the most contested issues in the debate is whether or not South Africa can afford it. That’s the topic we tackle in this last article in the series.

Debates about the affordability of a UBIG tend to focus on the “gross” financing costs - the amount of money the government needs to set aside to pay the grants at the outset - and the fiscal trade-offs that would have to be made. These debates ignore the economic impacts of introducing a UBIG and the mechanisms through which it generates additional revenue.

A UBIG paid to adults between the ages of 18 and 59 at the level of the Food Poverty Line (FPL) of R624 per month would have a gross cost of R255-billion per year.

But the first point is that not everyone would take it up. Research shows that a large group of the population, some of whom have alternative sources of income, may not opt to receive the UBIG. We can assume, based on historical uptake of other grants, that only 60% of the possible beneficiaries will be reached once the grant is in place, gradually improving to 80% over time.

If the UBIG is taken up by 60% of adults it would cost about R153-billion per year and at 80% uptake it would cost about R204-billion per year.

But the net cost would be much lower.

The net cost is the cost government has to finance, minus the benefits to government as a result of the initiative. This is useful to keep in mind because the UBIG boosts economic growth, and as a result revenue from taxes is increased.

The latest research on the use of the SRD grant shows that people use it to purchase food and basic necessities. People with lower incomes spend more of their income on goods produced in South Africa than people with higher incomes, and they also spend more near where they live. This means that domestic demand increases. This has a ripple effect through the economy, boosting the growth of firms and thereby employment. This stimulus impact is well supported by international evidence.

In addition, the lowest spending 70% of the population spends 81% of disposable income on items which carry VAT (based on data analysis from the Income and Expenditure Survey 2014/15). This means that about 12% of the money spent on grants is recouped through VAT. If there is an 80% uptake of a grant set at R624 a month, government would recoup about R24-billion from VAT alone. This means that, before accounting for the stimulus effect of the grant, R180-billion would be left to pay.

This amount could be further reduced through tax “claw-backs” such as a social security tax. In this case, low-income earners would receive more in the form of a UBIG than they pay in the social security tax, and high-income earners would pay more than the UBIG to support the payment of the grant to the working poor and the unemployed. Around 25% of the cost of a UBIG is returned via a progressive clawback mechanism such as the Social Security Tax (when levied at levels proposed by the IEJ).

The resulting income and revenue generated by the grant, combined with a progressive clawback from higher income earners, and an anticipated lag in uptake in the short- to medium-term overall, will result in a net cost of as low as 50% of the gross cost.

Progressive taxation is an important government lever to redistribute incomes to poor households. This form of taxation means that those who are wealthier contribute proportionally greater amounts in tax than those who are poorer. International evidence shows that progressive income tax, corporate taxes, and taxes on wealth are better at redistributing and improving incomes for poor households than regressive forms of tax such as VAT. They are also better at promoting increased employment and economic growth.

South Africa’s increasing levels of inequality warrant a progressively financed UBIG. Achieving this requires a careful and phased-in rebalancing of the taxation system which includes removing measures that currently disproportionately benefit the wealthy. A recent study by economists Maya Goldman and Ingrid Woolard on the role of income tax in reducing poverty in South Africa found that while the higher earners are paying more income tax in absolute terms, their income has increased more than their income tax payments.

Therefore, despite claims that South African taxpayers are overburdened, there is scope to increase tax for the wealthy and high-income earners.

Professor Alex van den Heever has shown that the top 10% of income earners also receive massive government subsidies in the form of pension fund contribution deductions and retirement fund assets, and others have made the same observation about private medical aid rebates. He estimates subsidies on pension fund contributions to be R87-billion, while subsidies on the return on investments of retirement fund assets are estimated to be R46-billion. This is a total subsidy of R133-billion on retirement fund benefits alone to wealthier South Africans, which could benefit poor households but instead contributes to the high levels of inequality the country faces.

Aroop Chatterjee and other economists have shown that a wealth tax on the wealthiest 1% of the population - just 340,000 people - could raise R143-billion a year.

The IEJ has also shown that a VAT on luxury goods of 25% would raise an average of R9-billion annually.

Collectively, these revenues and other sources of income, including a reduction in wasteful and irregular expenditure, could be used to finance the UBIG.

All in all, the IEJ’s work on financing options shows that the country has at least 18 financing instruments available, which, appropriately selected and sequenced, could finance a UBIG. There needs to be serious engagement with these and other options, rather than, as is the case with the National Treasury and some business think-tanks, a refusal to consider them because they raise uncomfortable questions around wealth redistribution.

Many arguments against the affordability of UBIG are ideological and not supported by evidence.

A Universal Basic Income Grant is feasible and affordable without compromising the country’s fiscal position, and without cutting spending on public services or on existing grants.